Tokenization, the process of creating digital tokens on a blockchain that represent ownership of assets, is once again gaining momentum in the financial services industry. Despite the challenges faced since its introduction in 2017, recent developments suggest that tokenization may be reaching an inflection point, presenting a new frontier for asset managers. Let's explore the potential benefits that tokenization offers:

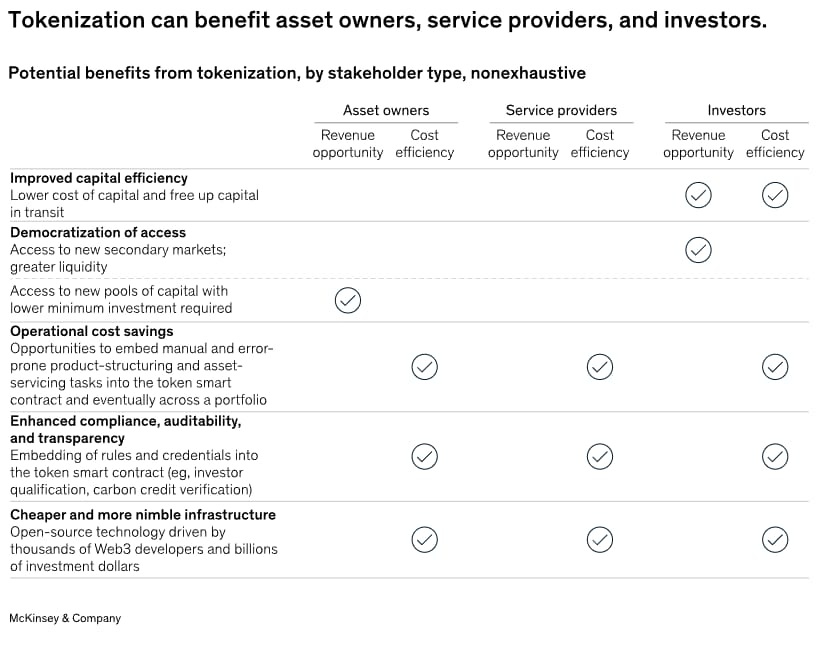

Improved Capital Efficiency: By enabling faster settlement times, such as minutes instead of the current T+2 standard, tokenization can result in significant cost savings, especially in high-interest-rate environments. These savings could be the most immediate and impactful benefit for asset managers.

Democratization of Access: Tokenization facilitates fractional ownership, which can improve liquidity and democratize access to previously illiquid assets. However, regulatory limitations may restrict some tokenized assets to accredited investors only, and true democratization will require tokenized asset distribution to reach a much larger scale.

Operational Cost Savings: Asset programmability through smart contracts can automate processes like interest calculations and coupon payments, reducing costs and errors associated with manual operations. This is particularly beneficial for asset classes with highly manual and bespoke processes, such as corporate bonds and other fixed-income products.

Enhanced Transparency and Compliance: Tokenization allows for automated compliance checks, immutable recordkeeping, and real-time auditing. For example, in the case of carbon credits, blockchain technology can provide a transparent and tamper-proof record of the purchase, transfer, and retirement of credits, enhancing trust in the ecosystem.

Cheaper and More Nimble Infrastructure: As blockchain technology continues to evolve, driven by Web3 developers and venture capital investments, asset managers can benefit from innovations in smart contracts and token standards, further reducing operating costs.

While challenges related to infrastructure, implementation costs, market maturity, regulation, and industry alignment persist, recent advances suggest that tokenization may be gaining momentum:

Approximately $120 billion of tokenized cash is now in circulation in the form of fully reserved stablecoins.

Higher interest rates have improved the economics for some tokenization use cases, particularly those dealing with short-term liquidity.

Many financial services companies have significantly grown their digital asset teams and capabilities over the past five years, leading to increased experimentation and expansion of tokenization capabilities.

To prepare for a tokenized world, asset managers should consider reexamining the underlying business cases, building out tech and risk capabilities, forming ecosystem relationships (particularly for asset distribution), and participating in standard-setting to avoid further fragmentation of liquidity, data, and composability.

As the tokenization landscape continues to evolve, asset managers who take proactive steps to understand and embrace this technology may be well-positioned to capitalize on the benefits it offers, despite the challenges that lie ahead. The time may be right for asset managers to explore this new frontier and unlock the potential of tokenization.